Financial technology startup Spence Labs has launched Enjoy Now, Pay Later™, an industry-first point-of-sale financing option for cannabis consumers. The feature is available now in the Spence payment platform as well as the recently announced white label service.

“There are no consumer credit options in the cannabis industry today. You have only one option at the dispensary: purchase product with the money you have on hand, either in cash or with your Spence account,” Rentner said. “Enjoy Now, Pay Later gives customers the purchasing power to buy more of the products they like when they’re available.”

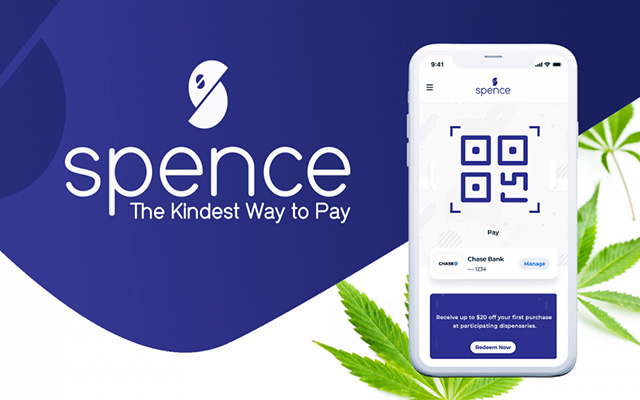

The innovative Spence payment platform eliminates the need to carry cash or visit an ATM inside the dispensary by allowing customers to pay for cannabis purchases with their mobile phones or online. Consumers can sign up in just minutes for a Spence account at GoSpence.com, then pay digitally in just seconds from their web-based Spence app.

When ready to purchase, customers simply display a unique QR code to be scanned by dispensary staff, then enter a PIN to confirm their purchase, either with available funds or through the new Enjoy Now, Pay Later financing option. Funds are transferred automatically with bank level encryption and processed by an FDIC-insured banking partner.

There are no fees or interest charges for the consumer using the Enjoy Now, Pay Later payment option. Upon sign-up for the service, the consumer consents to a schedule of up to four payments, and the automated system renders an approval decision within seconds.

“Spence’s Enjoy Now, Pay Later is revolutionary in cannabis, where credit cards are not available for use. Companies like Affirm, Klarna and PayPal have all launched similar products to great success over the last few years,” Rentner said. “The point-of-sale financing world has grown at an unprecedented rate due to COVID-19, and we felt the time was right to bring this type of solution to the cannabis industry.”

“For dispensaries, point-of-sale financing represents another opportunity to move away from cash transactions, as well as an incentive for customers to spend more per visit,” he added. A Forrester Research study found that cart size increases by 15% for businesses that offer consumer credit options like Enjoy Now, Pay Later. Furthermore, 30% of shoppers using consumer credit said they would not have made a purchase if financing were not offered.

For more information about Enjoy Now, Pay Later and Spence’s other services, please visit www.gospence.com.