The top-grossing pharmaceutical research and manufacturing companies dominate the drug market. Their research and development (R&D) money buys the attention of the leading physicians and politicians in America. The trade group, the Pharmaceutical Research and Manufacturers of America (PhRMA), is most commonly referred to as ‘Big Pharma’ and they recover more money on their drugs than any university or government agency involved in the approval process. In turn, some of that money is spent on political campaign donations.

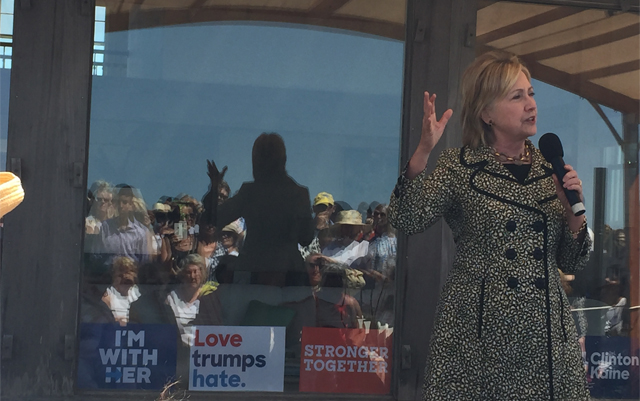

On campaign finance, Clinton says she believes America’s democracy should work for everyone, not just the wealthy and well-connected. In a quote highlighted by her campaign, she said, “I will fight hard to end the stranglehold that the wealthy and special interests have on so much of our government.”

The GOP strategy on cannabis has yet to completely unfold; the Republican nominee, Donald Trump, has said he would negotiate prices for Medicare patients, saving $300 billion. So far, he’s received nearly $60,000 from pharmaceutical interest groups according to OpenSecrets.org.

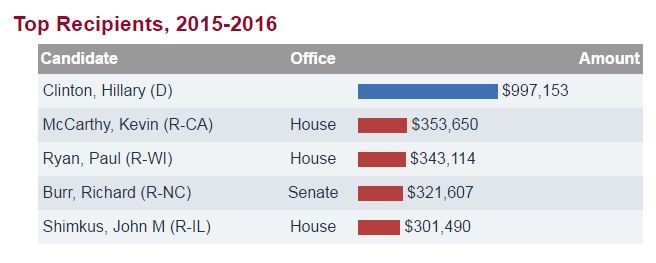

Below is a table showing the top recipients of money from the pharmaceutical sector. In 2015-2016, the only politician to get near the one million dollar mark is Democratic presidential nominee, Hillary Clinton.

At a small gathering in Nantucket this summer, Clinton donors gathered to financially support the candidate. A cannabis entrepreneur told The Marijuana Times there was no talk of cannabis policy at the event, “it wasn’t even on their radar.”

Read more: A Cannabis Policy Insider Walks into a Clinton Fundraiser

Meanwhile, Clinton denounces commonplace practices of Big Pharma on her campaign website. Her outlined policy to lower drug prescription include:

- Require drug companies that benefit from taxpayers’ support to invest in research, not marketing or profits.

- Stop direct-to-consumer drug company advertising subsidies, and reinvest funds in research

- Increase competition for prescription drugs, including specialty drugs, to drive down prices and give consumers more choices.

- Prohibit “pay for delay” arrangements that keep generic competition off the market.

- Allow Americans to import drugs from abroad

It’s clear that Clinton’s platform on campaign finance and drug prescription policy is at odds with the financial interests of the special interest group. Her campaign’s pockets are lined with money from companies like Pfizer, AstraZeneca and Johnson & Johnson, yet her ideas would lower profits for the special interest group.

Case Study: Johnson & Johnson

The cherry-picking of information and promotion of off-label drugs is common practice in the industry. It only takes a look at the record of one of the most trusted companies in America, Johnson & Johnson.

In April, the former FDA chief Margaret Hamburg and Johnson & Johnson were accused of hiding the dangers of the ‘2010 antibiotic of the year’ drug, Levaquin (levofloxacin) to increase profits. The drug has been in the news for multiple lawsuits going as far back as at least 2012. Now, Johnson & Johnson and their pharmaceutical unit are facing a new bout of lawsuits in federal court over the antibiotic for claims of the drug causing “debilitating” nerve damage to patients. This latest round of lawsuits were filed after the FDA issued a warning in May. They cautioned against the disabling side effects of levofloxacin, and other drugs in the fluoroquinolone family, generally outweighing the benefits for certain patients. Johnson & Johnson also made headlines earlier in 2016, with their $72 million payout to the family of a woman who died from ovarian cancer, which she claimed was caused by using the brand’s talcum powder and other products.

There is one way to stop companies like Johnson & Johnson from marketing unsafe drugs and it starts with understanding the protections afforded by pharmaceutical patents.

The Patent Game

Medicines protected by patents tend to be expensive, as pharmaceutical companies try to recoup their research and development (R&D) costs. The skyrocketing of prices was such a huge problem for third-world countries, that the World Trade Organization (WTO) had to curb the prices of certain life-saving medicines through generic competition with the 1995 TRIPS Agreement.

The TRIPS agreement set minimum standards for the protection of intellectual property, including patents on pharmaceuticals, in an effort to get medicine to more people. Take the AIDS epidemic, for example:

“Successful AIDS programmes, such as those in Brazil and Thailand, have only been possible because key pharmaceuticals were not patent protected and could be produced locally at much lower cost. For example, when the Brazilian Government began producing generic AIDS drugs in 2000, prices dropped. AIDS triple-combination therapy, which costs US $10,000 per patient per year in industrialized countries, can now be obtained from Indian generic drugs company, Cipla, for less than US $200 per year. This puts ARV treatment within reach of many more people.” – WTO

The intention of U.S. patents was to encourage research and innovation; instead, it’s done the exact opposite. Patented drugs prices are set by the patent holder — usually a Big Pharma company. In turn, the profits recoup their R&D costs and then some. Therefore, it’s in their best financial interests not to invest in researching a drug because it’s too novel or obvious to become patented.

In an attempt to undermine the practice, the Bolar provision to the WTO agreement, allows some countries’ manufacturers of generic drugs to basically copy the patent without permission, before the patent expires. Although, the generic producers will still have to hold their version until the patent expiration date. For the future, solutions to the patent problem are being discussed. For example, encouraging government-funded clinical research into public-domain drugs, or guaranteeing market exclusivity to recoup costs.

It’s a fact that profits on sales in the U.S. market fuel worldwide R&D, however, American R&D for cannabis is hundreds of millions of dollars short and years away from FDA approval. Research shows the best strategies for R&D is patent-free approaches to early stage research, and university-industry collaboration. Until that happens for the cannabis plant, the best hope for chemically understanding it lies in countries without federal prohibition such as Israel, the Czech Republic, and Canada.

Read The Future of Clinical Cannabis: Part 1 here and Part 2 here.